CREDIT SCORE

What is a Good Credit Score?

Credit Scores can range from 300 to 850, a good credit score is 700 and above. A risky score is one that hovers at or below 500. A credit score is a group of numbers on a scale used to rate your creditworthiness. Creditors use the credit score to determine the rate that they will charge you to obtain credit; it makes the difference at whether you pay an extra $500 or $600 on your home mortgage. Insurance companies use it to determine risk levels. Job applicants seeking employment will be screened based upon information from the credit score.

The key to improving your credit score is:

- Paying your bills on time.

- Use oldest credit cards to charge small items such as gasoline charges to keep them active, but paying off the charge within a few days.

- Keeping credit card charges below 25-30 percent

- Dispute negative items listed on your credit report, and get them removed. Bankruptcies that are beyond ten years should be disputed and removed.

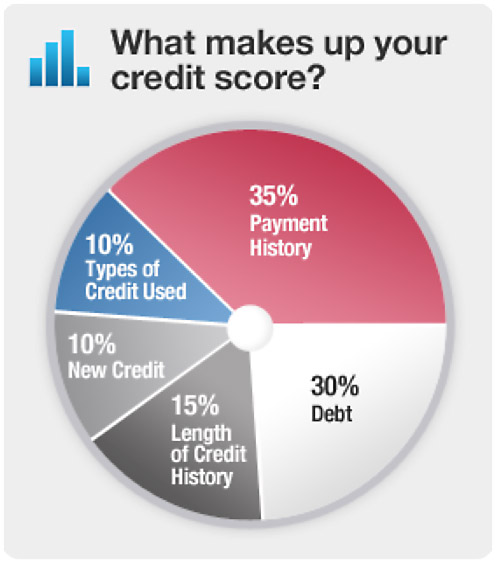

Factors that determine your credit score

The formula of the credit score is from Fair Isaac Company, commonly referred to as FICO. FICO identifies five factors and the importance given to each factor.

- Payment history - 35%

- Amounts owed - 30%

- Length of credit history - 15%

- New credit - 10%

- Types of credit used - 10%